2018 Employer Health Benefits Survery Kaiser Family Foundation

Employer-sponsored insurance covers over half of the non-elderly population; approximately 152 1000000 nonelderly people in total.1 To provide electric current information about employer-sponsored health benefits, the Kaiser Family Foundation (KFF) conducts an annual survey of private and not-federal public employers with 3 or more than workers. This is the twentieth survey and reflects employer-sponsored wellness benefits in 2018.

Plan ENROLLMENT

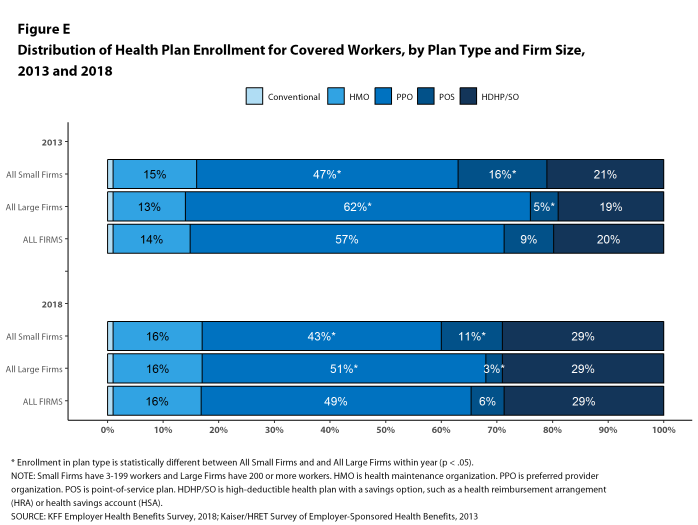

PPOs go along to be the virtually mutual plan blazon, enrolling 49% of covered workers in 2018. Twenty-nine percent of covered workers are enrolled in a high-deductible program with a savings option (HDHP/SO), 16% in an HMO, 6% in a POS programme, and less than i percent in a conventional (besides known as an indemnity) plan [Figure E]. Covered workers in the South (55%) are more likely to be enrolled in PPOs than workers in other regions. Covered workers in the Midwest (39%) are more likely to be enrolled in HDHP/SOs than workers in other regions, while covered workers in the Due west (nineteen%) are less likely to be enrolled in HDHP/SOs. The share of covered workers enrolled in POS plans decreased from 10% in 2017 to half dozen% this year.

Figure E: Distribution of Health Plan Enrollment for Covered Workers, past Plan Type and Firm Size, 2013 and 2018

Self-Funding. Threescore-one percent of covered workers, including thirteen% of covered workers in minor firms and 81% in large firms, are enrolled in plans that are either partially or completely self-funded. The percent of covered workers in self-funded plans increases as the number of workers in a firm increases. The percentages of small and large firms with cocky-funded plans are similar to those concluding year.

In recent years, insurers have begun offering health plans that provide a nominally self-funded pick for small or mid-sized employers that incorporates stoploss insurance with relatively low attachment points. These plans are sometimes referred to equally level-funded plans because insurers calculate an expected monthly expense for the employer that includes a share of the estimated annual expense for benefits, the premiums for the stoploss protection, and an administrative fee. Due to the complication of the funding (and regulatory status) of these plans, and because employers often pay a monthly amount that resembles a premium, they may be dislocated as to whether or not their health program is self-funded or insured. To examination this, we asked employers with fewer than 200 workers that responded that they had an insured wellness plan whether they had a level-funded plan. Amongst pocket-size firms that responded that they had an insured plan, 6% reported that they had a level-funded programme.

EMPLOYEE COST SHARING

Well-nigh covered workers must pay a share of the cost when they use health care services. Eighty-five percentage of covered workers have a full general annual deductible for single coverage that must be met before near services are paid for by the plan, an increase from concluding twelvemonth [Figure F]. Even workers without a general annual deductible oftentimes face other types of toll sharing when they apply services, such as copayments or coinsurance for office visits and hospitalizations.

Among covered workers with a general annual deductible, the average deductible amount for single coverage is $1,573, like to the average deductible terminal year. The boilerplate deductible for covered workers is higher in small firms than big firms ($2,132 vs. $one,355).

Assigning a null deductible corporeality to those in plans without a general annual deductible, the average deductible amidst all covered workers is $1,350, an increase from the amount last twelvemonth ($1,221). Over the by five years, the average almanac deductible among all covered workers has increased 53%. Forty-two percent of covered workers in small firms and 20% of covered workers in large firms are in a plan with a deductible of at to the lowest degree $2,000 for single coverage, like to the percentages last year.

Deductibles accept increased in recent years due to higher deductibles within plan types and college enrollment in HDHP/SOs. While growing deductibles in PPOs and other plan types generally increase enrollee out-of-pocket liability, the shift in enrollment to HDHP/SOs does not necessarily do so because most HDHP/And then enrollees receive an account contribution from their employers. 8 percent of covered workers in an HDHP with a Wellness Reimbursement Arrangement (HRA) and 2% of covered workers in a Health Savings Business relationship (HSA)-qualified HDHP receive an account contribution for single coverage at least equal to their deductible, while some other 37% of covered workers in an HDHP with an HRA and 26% of covered workers in an HSA-qualified HDHP receive account contributions that, if applied to their deductible, would reduce their deductible to less than $1,000.

Whether they face a full general almanac deductible or not, a large share of covered workers as well pay a portion of the cost when they visit an in-network md. For principal care, 66% of covered workers take a copayment (a fixed dollar amount) when they visit a doc and 24% accept coinsurance (a percentage of the covered corporeality). For specialty care, 64% face a copayment and 27% face up coinsurance. The average copayments are $25 for main intendance and $forty for specialty care. The average coinsurance is 18% for both primary and specialty intendance. These amounts are similar to those in 2017.

Most workers also face boosted price sharing for a hospital admission or outpatient surgery. Subsequently any general annual deductible is met, 68% of covered workers have coinsurance and 11% have a copayment for hospital admissions. The average coinsurance rate for a hospital access is 19% and the average copayment is $284 per hospital admission. The toll-sharing provisions for outpatient surgery follow a similar pattern to those for infirmary admissions.

While almost all (99%) covered workers are in plans with a limit on in-network cost sharing (chosen an out-of-pocket maximum) for single coverage, in that location is considerable variation in the actual dollar limits. Fourteen percent of covered workers in plans with an out-of-pocket maximum for single coverage accept an out-of-pocket maximum of less than $2,000, while xx% have an out-of-pocket maximum of $6,000 or more than.

Figure F: Percentage of Covered Workers With Diverse Single Coverage General Annual Deductible Levels, 2013 and 2018

HEALTH AND WELLNESS PROGRAMS

Firms continue to evidence considerable interest in programs that help workers identify health issues and manage chronic weather, including health risk assessments, biometric screenings, and health promotion programs.

Wellness Risk Assessments. Amongst firms offering health benefits, 37% of small firms and 62% of large firms provide workers the opportunity to complete a wellness risk assessment. A health chance assessment includes questions near a person'due south medical history, health condition, and lifestyle. Fifty-one percent of large firms with a wellness chance cess plan offer an incentive to encourage workers to consummate the assessment. Incentives may include: souvenir cards, merchandise or similar rewards; lower premium contributions or cost sharing; and financial rewards, such equally cash, contributions to health-related savings accounts, or avoiding a payroll fee.

Biometric Screenings. Among firms offering health benefits, 21% of minor firms and 50% of large firms provide workers the opportunity to complete a biometric screening. A biometric screening is an in-person health examination that measures a person'southward gamble factors, such as body mass index (BMI), cholesterol, blood pressure, stress, and diet. Nosotros practise not consider preventive health services covered by the plan to exist biometric screening. Sixty percent of large firms with biometric screening programs offer workers an incentive to complete the screening, similar to the incentives for completing health risk assessments.

Additionally, amongst large firms with biometric screening programs, 15% advantage or penalize workers based on achieving specified biometric outcomes (such every bit coming together a target BMI). The size of these incentives varies considerably: amid big firms offering a reward or penalty for meeting biometric outcomes, the maximum reward is valued at $150 or less in xv% of firms and more than than $1,000 in 19% of firms.

Wellness and Wellness Promotion Programs. A majority of firms offering wellness benefits offer programs to assistance workers identify health risks and unhealthy behaviors, and amend their lifestyles. Fifty-3 percent of modest firms and 82% of large firms offer a program in at to the lowest degree one of these areas: smoking abeyance; weight management; and behavioral or lifestyle coaching. Among large firms offer at least one of these programs, 35% offer workers an incentive to participate in or complete the program.

Equally wellness screenings and health programs have go more complex, incentives take become more sophisticated and may involve participating in or coming together goals in different programs (e.chiliad., completing an cess and participating in a health promotion action). To better empathise the combined incentives or penalties facing program participants, we asked big firms that had any incentives for health gamble assessments, biometric screenings, or the specified health and wellness promotion programs what the maximum incentive was for a worker for all of their programs combined. Among large firms with any type of incentive, 15% take a maximum incentive of 150 or less; 39% have a maximum incentive between $151 and $500; 21% have a maximum incentive between $501 and $1,000; 19% have a maximum incentive between $1,001 and $2,000; and half dozen% accept a maximum incentive of more than than $2,000 [Effigy H].

Figure H: Among Large Firms That Offer Workers an Incentive to Participate In or Complete Whatever Health Promotion Programs, Maximum Annual Value of the Incentive for All Programs Combined, 2018

SITES OF Intendance

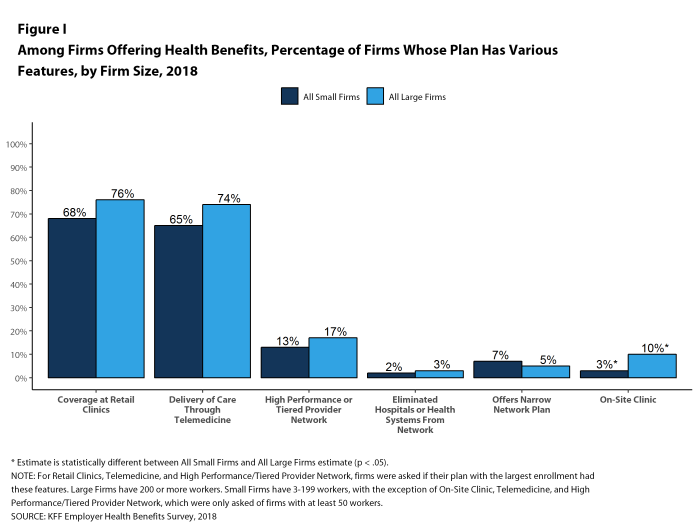

Telemedicine. Seventy-four percent of big firms offering health benefits cover the provision of health intendance services through telemedicine in their largest health plan [Effigy I]. Telemedicine is the delivery of health care services through telecommunications to a patient from a provider who is at a remote location, including video chat and remote monitoring. Firms with 1,000 or more than workers are more likely to embrace services provided through telemedicine than smaller firms.

Retail Wellness Clinics. Seventy-six per centum of big firms offer health benefits comprehend health care services received in retail clinics, such every bit those located in pharmacies, supermarkets and retail stores, in their largest health programme [Figure I]. These clinics are ofttimes staffed past nurse practitioners or medico administration and treat pocket-size illnesses and provide preventive services.

On-Site Health Clinics Only ten% of big firms offering health benefits have an on-site health clinic for their employees at one or more than of their major locations. A large share of these firms report that employees tin receive treatment for non-work-related illnesses at their on-site clinics.

PROVIDER NETWORKS

High Performance or Tiered Networks. Seventeen percent of large firms that offer health benefits include a loftier-operation or tiered provider network in their health programme with the largest enrollment, a similar pct to last yr [Figure I]. These arrangements identify providers that are more efficient and by and large provide financial or other incentives for enrollees to utilise the selected providers. Firms with 1,000 or more than workers are more likely than smaller firms to contain a high-functioning or tiered network into their largest program.

Narrow Networks. Five percentage of large firms offering health benefits offer a plan they consider to be a narrow network plan, similar to the percentages for the past two years [Figure I]. Narrow network plans limit the number of providers who tin can participate in order to reduce costs, and are more often than not more restrictive than standard HMO networks. Firms with five,000 or more workers offering health benefits are more likely than firms of other sizes to offer at to the lowest degree one plan with a narrow network.

Eliminated Hospitals or Wellness Systems. Simply 3% of large firms report that they or their health programme eliminated a hospital or health system in the by yr in order to reduce the costs of their programme, similar to the percentage reported last twelvemonth [Figure I]. Firms with 5,000 or more than workers offering health benefits are more than likely to say that either they or their insurer eliminated a hospital or health organisation from a provider network to reduce costs than firms of other sizes.

Figure I: Amongst Firms Offering Health Benefits, Per centum of Firms Whose Plan Has Various Features, by Firm Size, 2018

REPEAL OF Tax Penalty FOR INDIVIDUALS WITHOUT Health INSURANCE

The 2017 tax law eliminated the taxation penalty for people who do not have health insurance (sometimes called the 'individual mandate') beginning in 2019. Nine percent of small firms and 24% of big firms report that they wait fewer employees and dependents to participate in their wellness plans as result of the change. Additionally, 5% of small firms and 10% of large firms said that they expect to modify the do good options for at least some employees as a outcome of the change.

Determination

This year continues a period of stability and relatively low toll growth for employer-provided coverage. While premium growth continues to exceed increases in earnings and inflation, the differences are small-scale compared to recent periods which, along with low underlying health spending growth, may help explicate the credible reluctance of employers and plans to make many changes in the market [Effigy C].

The one area where we accept seen change is higher deductibles – the average deductible for single coverage among all workers increased 53% since 2013, driven in function by a fifty% increase in HDHP/SO enrollment over that catamenia. Higher deductibles take helped to keep premium increases relatively low, merely it is unclear how long that trend will continue. Given the importance of health benefits to workers and prospective workers, employers may find it increasingly hard to impose higher cost sharing in what is substantially a full employment economy. The growth in HDHP/Then enrollment has stalled over the by three years, which may be a sign of employer reluctance to rock the do good boat for their workers. If underlying health care prices and service use begin to grow as function of stronger economic growth, employer and health plans may demand to expect for tools other than higher cost sharing to accost the pressures that would lead to higher premium growth.

METHODOLOGY

The Kaiser Family Foundation 2018 Employer Wellness Benefits Survey reports findings from a telephone survey of 2,160 randomly selected non-federal public and private employers with three or more workers. Researchers at NORC at the University of Chicago and the Kaiser Family unit Foundation designed and analyzed the survey. National Research, LLC conducted the fieldwork between January and July 2018. In 2018, the overall response rate is 32%, which includes firms that offer and exercise not offer health benefits. Among firms that offer health benefits, the survey's response rate is as well 32%. To improve estimates for small firms, the 2018 survey had a significantly larger sample than in previous years; the increased sample size led to both more firms completing the survey and a lower response rate than in years past. Unless otherwise noted, differences referred to in the text and figures use the 0.05 conviction level as the threshold for significance. Values beneath 3% are non shown on graphical figures to improve the readability of those graphs.

For more than information on the survey methodology, please visit the Survey Pattern and Methods department at http://ehbs.kff.org/.

Filling the need for trusted information on national health issues, the Kaiser Family Foundation is a nonprofit arrangement based in San Francisco, California.

Source: https://www.kff.org/report-section/2018-employer-health-benefits-survey-summary-of-findings/

0 Response to "2018 Employer Health Benefits Survery Kaiser Family Foundation"

Post a Comment